Workers compensation codes are used to store the various workers compensation insurance rates applicable to your company in order to calculate a workers comp expense amount for each timecard entry processed through the payroll system.

- Workers compensation codes are used to store the various workers compensation insurance rates applicable to your company in order to calculate a workers comp expense amount for each timecard entry processed through the payroll system.

- If the rate is not zero, then AccuBuild will expense the calculated amount to the general ledger account defined by either the associated department code (as entered on the timecard screen) or to the default labor burden accounts as defined on the Ledger Interface of the Properties > Payroll > Ledger Interface tab .

- If a timecard transaction is linked to a job number, then the payroll burden calculated for that one transaction will be expense to the job. In addition, AccuBuild will accrue the liability in the account that has been set up in the Workers Comp Insurance field on the aforementioned screen.

Please refer to the documentation on the Workers Comp - System Rules for workers comp codes located in the Frequently Asked Questions section of the Payroll Manual for additional information.

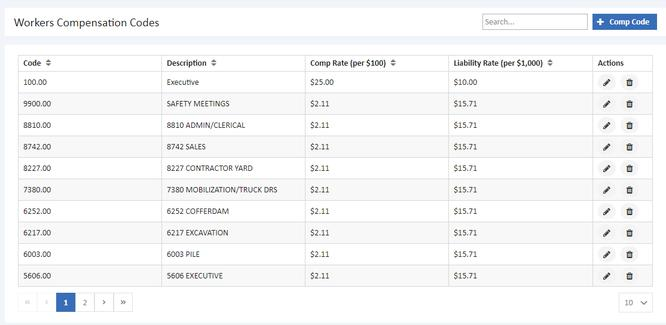

- To set up a new workers comp code, select the +Comp Code button. Information on an existing code can be changed at any time by selecting Edit. Workers comp codes can be deleted by selecting the delete button. Add Comp code, Description, Compensation Rate and Liability Rate to configure a new comp code.

- Comp Rate - Enter the workers comp rate as per $100 of payroll wages. If the rate is $15.75 per $100 of payroll wages, then enter the rate as $15.75; do not enter the rate as $0.1575. Be sure to consider any experience modification factor when entering the rate. For example, if your company's experience modification factor is 85%, and the workers comp rate as stated on the policy is $15.75, then enter $13.39 as the rate in AccuBuild.

- Liability Rate - This field is optional, but if used, then a liability insurance amount will be calculated and added to the payroll burden expense amount.

Hint - If your workers compensation insurance on a project is carried by the project owner, then set up a separate code with a rate of zero and link the code directly to the job. AccuBuild will use the job's workers comp code instead of the employee's code or department code to calculate the workers comp expense. The transaction detail will still be reported on the Workers Compensation under the code classification along with the zero rate.

Click Here to download User Guide

Click Here to download User Guide