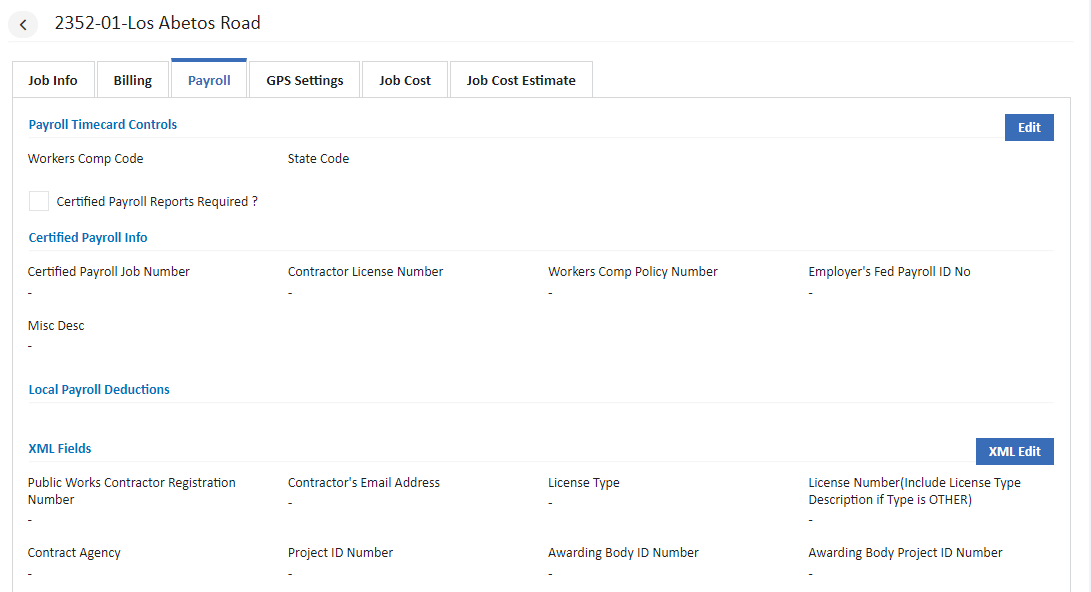

The data on the Payroll Tab is mostly used to control whether certified payroll may be entered on a job but this screen also contains other fields that control job related payroll deductions and certified payroll Info. The info can be undated using Edit and XML Edit options.

Payroll Timecard Controls

- Workers Comp Insurance Code - This field is only used in situations where another entity is providing the workers comp insurance for your company and is billing you for the cost. A special workers comp code is set up for the job with a rate of zero. Any timecard entry charged to this job would default with this special workers comp code thus preventing AccuBuild from creating a workers comp expense amount for this job. This information will be detailed on the Workers Compensation Report.

- State Code - A timecard entry that is entered for a job that contains a state code is processed with that state code as long as the employee has been set up with the same state code. Otherwise, the timecard entry can only be charged to a state code that is set up in the employee's file.

Certified Payroll Info

Each new job that is added to the job list is automatically set up for certified payroll. If certified payroll is required on a job then the Certified Payroll Info section of the screen should be completed as this information will be printed on the certified payroll report. The Contractors License Number, the Workers Comp Policy Number and the Employer's Fed Payroll I.D. No. fields are automatically updated with the data that has been entered on the Global Settings > Company Info / Accounting screen. If you do not want this information to print on your certified payroll report, then simply delete the data from each field on this screen using Edit option.If certified payroll reports are not required on a job, then click on the Certified Payroll Reports Required ? box to enable or disable this feature.

Note: If you disable the certified payroll function on a job and then process payroll checks for that job, then you cannot produce certified payroll reports on those checks even if you later enable the certified payroll function. The checks would have to be either voided and reissued or a handwritten payroll check would need to be entered to reverse the original timecard entries and then post the entries correctly.

Local Payroll Deductions

A job may be set up with up to three local payroll deductions. These deductions are for such items as city or county taxes that are applicable to projects located in a specific area. These tax amounts must be deducted from an employee's check when timecard entries are coded to the specific job. The Payroll system will scan the job file first when searching for local payroll deductions.

Click Here to download User Guide

Click Here to download User Guide